Unum Critical Illness Insurance provides a lump-sum benefit upon diagnosis of covered illnesses, helping cover medical expenses and financial losses during recovery. The payout chart PDF outlines specific percentages for various conditions, ensuring transparency in benefit amounts based on severity. This coverage offers peace of mind, allowing focus on healing rather than financial strain.

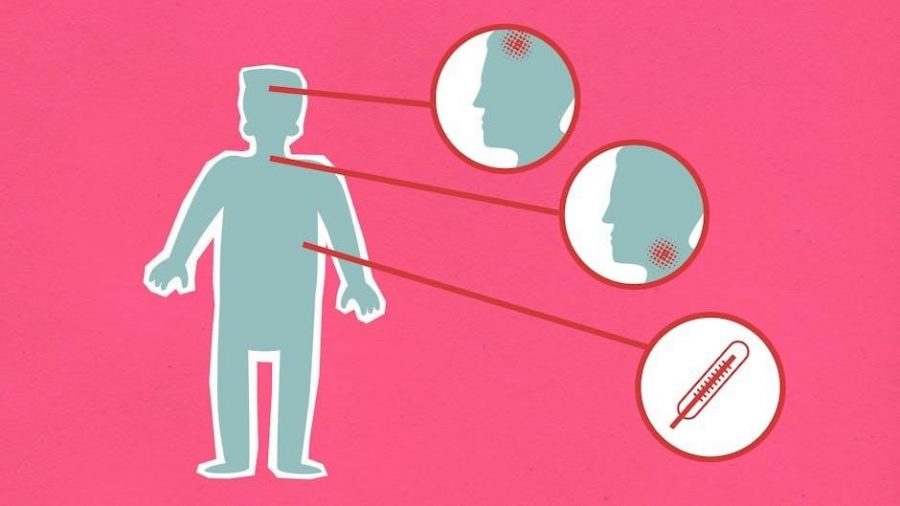

What is Critical Illness Insurance?

Critical illness insurance provides a lump-sum benefit upon diagnosis of a covered serious health condition, such as heart attack, stroke, or cancer. It helps policyholders cover medical expenses, lost income, and daily living costs during recovery. This type of insurance is designed to alleviate financial stress, allowing individuals to focus on healing without worrying about monetary burdens.

The payout is typically a one-time payment, offering flexibility in how funds are used. Unum’s payout chart PDF outlines the specific percentages paid for various conditions, ensuring transparency in benefit amounts based on the severity of the illness. This coverage is invaluable for maintaining financial stability during unexpected health crises.

Why is Critical Illness Insurance Important?

Critical illness insurance is crucial as it provides financial protection during unexpected health crises, such as heart attacks or cancer diagnoses. It helps cover out-of-pocket medical expenses, lost income, and daily living costs, ensuring you can focus on recovery without financial strain.

This coverage offers peace of mind, safeguarding against potential financial setbacks and allowing you to prioritize your health and well-being during challenging times;

Understanding the Unum Critical Illness Payout Chart

The Unum Critical Illness Payout Chart provides a clear breakdown of benefit percentages for various conditions, ensuring transparency in how payouts are determined based on diagnosis severity.

What is Included in the Payout Chart?

The Unum Critical Illness Payout Chart details specific percentages for various critical illnesses, such as heart-related conditions and chronic diseases. It outlines the severity-based payouts, ensuring clarity on benefit amounts for diagnosed conditions. The chart also includes general terms and exclusions, providing a comprehensive overview of what is covered and how payouts are structured for each eligible condition.

How to Interpret the Payout Chart

The Unum Critical Illness Payout Chart lists specific conditions with corresponding payout percentages. Each condition is assigned a percentage based on its severity, which determines the benefit amount. For example, major coronary artery disease might offer a 50% payout, while minor cases may provide 10%. The chart ensures clarity on how benefits are calculated, helping policyholders understand their potential payouts based on diagnosed conditions and their severity levels.

Coverage Details and Benefits

Unum Critical Illness Insurance offers comprehensive coverage, providing lump-sum payouts for diagnosed conditions like heart disease and cancer; It helps cover medical expenses and lost income, ensuring financial stability during recovery.

What is Covered Under Unum’s Critical Illness Insurance?

Unum’s Critical Illness Insurance covers a range of serious health conditions, including heart attacks, strokes, and certain types of cancer. The policy provides lump-sum payouts based on the severity of the illness, as outlined in the payout chart. Covered conditions may include coronary artery disease, with payouts ranging from 10% to 50% of the benefit amount, depending on the severity. This financial support helps policyholders manage medical expenses and daily living costs during recovery.

Types of Critical Illnesses and Their Payouts

Unum’s Critical Illness Insurance covers various severe conditions, with payouts varying by diagnosis and severity. Heart attacks, strokes, and invasive cancers often qualify for 100% payouts, while less severe conditions like minor coronary artery disease may offer 10%-50% payouts. The payout chart provides detailed percentages for each illness, ensuring clarity on benefit amounts based on medical severity and policy terms.

How Unum Critical Illness Insurance Works

Upon diagnosis of a covered critical illness, Unum provides a lump-sum payout to help with medical expenses and financial needs. The payout chart PDF details benefit percentages for each condition, ensuring clarity and transparency in how benefits are distributed based on policy terms and medical severity.

Eligibility Criteria for Filing a Claim

To file a claim under Unum Critical Illness Insurance, you must have an active policy and be diagnosed with a covered critical illness. A waiting period may apply, and you must provide required medical documentation. The payout chart PDF outlines specific conditions and their corresponding benefit percentages, ensuring clarity on what is covered and how benefits are calculated based on policy terms and illness severity. This helps streamline the claims process and provides transparency for policyholders.

Steps to File a Critical Illness Claim

To file a claim, obtain the Unum Critical Illness Claim Form and complete it thoroughly. Include your personal and policy details, and have your physician certify the diagnosis. Attach all required medical documentation, such as test results and treatment plans. Submit the form to Unum via mail, fax, or online portal. Processing typically takes 5-10 business days, after which you’ll receive a payout if approved. Ensure all steps are followed accurately for a smooth process.

Factors Affecting Payout Amounts

Payout amounts vary based on the severity of the illness and policy terms, with percentages assigned to specific conditions as outlined in the payout chart.

Severity of the Illness and Payout Percentages

The severity of the illness directly impacts payout percentages, with more severe conditions receiving higher payouts. For example, major coronary artery disease may offer a 50% payout, while minor cases might provide 10%. Cancer and other chronic illnesses often have varying percentages based on progression or treatment requirements. The payout chart categorizes illnesses by severity, ensuring transparent and fair benefit allocations.

Impact of Policy Terms on Payouts

Policy terms significantly influence payout amounts, as specific conditions and waiting periods can affect benefit eligibility. For instance, certain policies may exclude pre-existing conditions or require a waiting period before payouts begin. Additionally, benefit caps or coverage limits outlined in the policy can restrict the maximum payout amount, ensuring alignment with the agreed-upon terms at enrollment. Understanding these details is crucial for accurate payout expectations.

Common Critical Illnesses Covered by Unum

Unum’s critical illness insurance covers heart-related conditions, cancer, and other chronic illnesses, with specific payout percentages outlined in the payout chart PDF for transparency and clarity.

Heart-Related Conditions and Their Payouts

Unum’s critical illness insurance covers various heart-related conditions, such as coronary artery disease and heart attacks. The payout chart PDF specifies that major coronary artery disease is covered at 50%, while minor cases may receive 10%. This structured approach ensures clarity on benefit amounts, helping policyholders understand their financial protection for heart-related health issues.

Cancer and Other Chronic Illnesses

Unum’s critical illness insurance provides coverage for various types of cancer and chronic illnesses, offering lump-sum payouts to help manage treatment costs. The payout chart PDF details specific percentages for different cancer stages and other chronic conditions, ensuring clear financial support during recovery. This coverage helps alleviate financial burdens, allowing individuals to focus on their health and well-being.

Claim Process and Requirements

Filing a claim with Unum requires submitting a completed form, medical records, and authorization for information release. The process ensures timely evaluation and payout distribution.

Documentation Needed for a Claim

To file a claim, you must submit a completed claim form, medical records confirming your diagnosis, and treatment details. Additional documentation may include proof of illness severity and authorization for information release. The payout chart PDF outlines specific requirements for each condition, ensuring accurate benefit calculations. Providing complete and accurate documentation is crucial for timely claim processing and payout approval.

Timeline for Claim Approval and Payout

Once a claim is submitted, processing typically takes a few weeks, depending on the completeness of documentation. Payouts are usually made shortly after approval. The timeline may vary based on the complexity of the case and the speed of documentation submission. The payout chart PDF provides clarity on expected timelines, ensuring policyholders are informed about when to anticipate their benefit payments.

Benefits of Having Unum Critical Illness Insurance

Unum Critical Illness Insurance offers financial protection during recovery, providing lump-sum payouts to cover medical expenses, daily living costs, and other needs, ensuring peace of mind.

Financial Protection During Recovery

Unum Critical Illness Insurance provides a lump-sum payout upon diagnosis, offering financial protection during recovery. This benefit helps cover out-of-pocket medical expenses, deductibles, and lost income, ensuring you can focus on healing without financial stress. The payout chart PDF details the specific percentages for various conditions, giving clarity on how much support you can expect, aiding in planning and maintaining stability during challenging times.

Flexibility in Using Payout Funds

Unum Critical Illness Insurance allows flexibility in using payout funds, enabling you to cover medical expenses, daily living costs, or other financial obligations. The lump-sum benefit can be used as needed, providing peace of mind during recovery. This flexibility ensures you can prioritize your health without worrying about financial strain, making it a valuable resource during challenging times.

Exclusions and Limitations

Unum’s Critical Illness Insurance includes exclusions and limitations, such as pre-existing conditions or specific policy terms. Review the payout chart PDF for detailed coverage restrictions to ensure eligibility.

Conditions Not Covered by the Policy

Unum’s Critical Illness Insurance excludes certain conditions, such as pre-existing illnesses, cosmetic treatments, or self-inflicted injuries. The payout chart PDF outlines specific exclusions, ensuring clarity for policyholders. It’s important to review the document to understand which conditions are not covered, avoiding potential claim denials. This transparency helps policyholders make informed decisions about their coverage needs.

Waiting Periods and Other Restrictions

Unum’s Critical Illness Insurance includes waiting periods and restrictions that policyholders must understand. These typically involve a timeframe before benefits can be claimed and may include age limitations or coverage caps. The payout chart PDF outlines these details, ensuring clarity on when and how benefits apply. Reviewing this document helps policyholders avoid unexpected claim delays or denials due to overlooked restrictions.

Comparing Unum with Other Providers

Unum’s Critical Illness Insurance includes waiting periods and restrictions that policyholders must understand. These typically involve a timeframe before benefits can be claimed and may include age limitations or coverage caps. The payout chart PDF outlines these details, ensuring clarity on when and how benefits apply. Reviewing this document helps policyholders avoid unexpected claim delays or denials due to overlooked restrictions.

Differences in Coverage and Payouts

Unum’s Critical Illness Insurance offers distinct coverage and payout structures compared to other providers. The payout chart PDF details specific percentages for illnesses like coronary artery disease (50% for major cases) and cancer. Unlike some competitors, Unum provides a lump-sum benefit upon diagnosis, offering flexibility in how funds are used. This transparency ensures policyholders understand their benefits clearly, setting Unum apart in the market.

Advantages of Choosing Unum

Unum offers comprehensive coverage with flexible payout options, providing financial relief during critical illnesses. The payout chart PDF ensures transparency, detailing exact percentages for various conditions. Unum also stands out with benefits for cancer recurrences and wellness incentives, enhancing overall value. Its user-friendly claims process and lump-sum payments make it a top choice for those seeking reliable financial protection during health crises.

How to Obtain the Unum Critical Illness Payout Chart PDF

To access the Unum Critical Illness Payout Chart PDF, visit the official Unum website, log in to your account, and navigate to the resources section. Download the chart directly from the “Documents” or “Benefits” tab. For assistance, contact Unum’s customer support team.

Downloading the PDF from Official Sources

To download the Unum Critical Illness Payout Chart PDF, visit the official Unum website and log in to your account. Navigate to the “Resources” or “Benefits” section, where the chart is available for direct download. Ensure you are accessing the document from Unum’s official portal to guarantee authenticity. If you encounter issues, contact Unum’s customer support for assistance. This ensures you receive the most accurate and updated information.

Understanding the PDF Content

The Unum Critical Illness Payout Chart PDF provides detailed information on benefit amounts for various conditions, such as heart-related diseases and cancers. It outlines specific payout percentages based on the severity of the illness, ensuring clarity on what to expect. The document also explains how benefits are calculated and lists any applicable exclusions or limitations. This transparency helps policyholders make informed decisions about their coverage and financial planning during challenging times.

Maintaining Your Critical Illness Coverage

Regularly review and update your policy to ensure it aligns with your needs. Renewal processes and policy updates are streamlined to maintain continuous protection and peace of mind.

Renewal Process and Policy Updates

The renewal process for Unum’s critical illness coverage is straightforward, ensuring continuous protection. Policy updates may include changes to payout percentages, which are detailed in the payout chart PDF. Reviewing the chart helps policyholders understand any adjustments. The process is designed to maintain coverage without interruption, with clear communication of any changes to ensure policyholders stay informed and protected.

Keeping Your Coverage Up-to-Date

Regularly reviewing your Unum critical illness policy ensures your coverage remains relevant and aligned with your needs. The payout chart PDF is updated periodically to reflect changes in benefits or terms. Proactively checking for updates helps you stay informed about new covered conditions or payout adjustments. This proactive approach ensures your financial protection remains robust and tailored to your evolving circumstances.

Real-Life Applications of the Payout Chart

The Unum payout chart provides clear guidance on benefit amounts for specific illnesses, helping individuals understand potential payouts and plan financially during recovery from conditions like heart disease or cancer.

Case Studies and Examples

Real-life examples from the Unum payout chart include a 50% payout for a heart attack and 100% for advanced cancer. These cases illustrate how the chart provides clear, condition-specific benefits, helping individuals understand potential payouts and plan accordingly. For instance, a minor coronary issue might offer a 10% payout, while severe illnesses yield higher amounts, demonstrating the chart’s practical application in financial planning during health crises.

How the Chart Helps in Financial Planning

The Unum payout chart provides clear payout percentages for various critical illnesses, enabling individuals to anticipate financial support. This transparency allows for better budgeting of medical expenses and daily living costs during recovery. By understanding potential payouts, policyholders can make informed decisions about their financial resources, ensuring they are prepared for unexpected health-related expenses and minimizing financial strain during challenging times.

The Future of Critical Illness Claims and Payouts

The future of critical illness insurance is expected to include more personalized policies, expanded coverage for emerging conditions, and advanced claims processing to ensure timely payouts and sustainability.

Trends in Critical Illness Insurance

Current trends in critical illness insurance include increased demand for flexible policies, rising coverage for chronic conditions, and advancements in claims processing. Insurers are focusing on personalized plans, offering lump-sum payouts for specific illnesses, and incorporating technology for faster claim approvals. Additionally, there is a growing emphasis on preventive care and early diagnosis benefits, aligning with modern healthcare needs and financial protection strategies.

Expected Changes in Payout Structures

Future payout structures may include more personalized plans based on individual health profiles and policy terms. Insurers could introduce tiered payouts for varying illness severity levels, offering higher percentages for severe cases. Expanded coverage for emerging chronic conditions and faster digital claims processing are also anticipated. These changes aim to enhance flexibility, transparency, and responsiveness to evolving healthcare and financial needs.

Understanding the Unum Critical Illness payout chart is crucial for financial protection during health crises. It ensures clarity and peace of mind, aiding recovery without financial strain.

Importance of Understanding the Payout Chart

Understanding the Unum Critical Illness payout chart is essential for transparency and financial preparedness. It outlines clear benefit percentages for various conditions, helping policyholders anticipate payouts and plan accordingly. This clarity ensures individuals can make informed decisions about their coverage and recovery, aligning expectations with policy terms and avoiding surprises during claims.

Final Thoughts on Unum Critical Illness Insurance

Unum Critical Illness Insurance offers valuable financial protection during life-altering health events. The payout chart provides clear insights into benefit amounts, ensuring transparency and helping policyholders prepare for unexpected medical expenses. This coverage not only alleviates financial strain but also allows individuals to focus on recovery and well-being, making it a vital component of a comprehensive insurance portfolio.