Anz house mortagae guide Canterbury

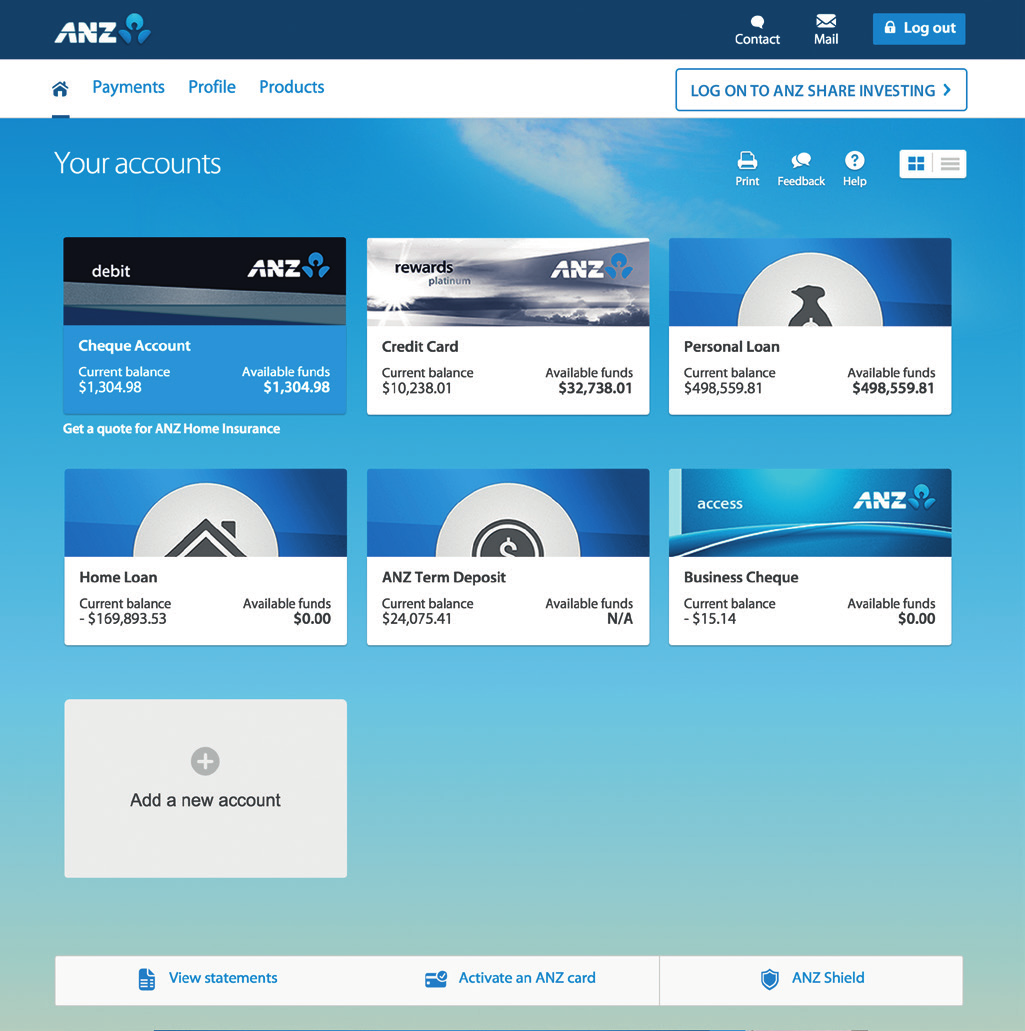

Home Loan Calculators and Tools ANZ Can’t make a lump sum payment in ANZ Internet Banking or ANZ goMoney – loan types The ability to make a lump sum payment in ANZ Internet Banking and ANZ goMoney is currently only available if your ANZ Home Loan has a floating interest rate or if you have an ANZ …

Mortgage4House.com Mortgage and Home Loan Guide

Mortgages Collections anz.com. A service brought to you by ANZ. LifeGuides Selling your home When’s the right time to sell? Try not to sell in a hurry. A seller in a hurry can’t wait to realise the true value of their home. Try not to sell on a whim or without doing your homework. Be wary of selling because you’ve already purchased elsewhere. It’s common for people to rush into a purchase because they fall in love, ANZ Mortgages Servicing. To 'make changes' to your existing ANZ Home Loan or Investment Loan: ANZ Internet Banking: Log on to ANZ Internet Banking to manage your loan online. View demonstration to find out more about managing your ANZ Home or Investment Loan online. Phone: Call 13 25 99, 8.00am to 9.30pm AEST, Monday to Friday Fax: 1300 655 706 Mail: ANZ Mortgages Servicing Locked Bag 9.

This handy guide covers which banks offer mortgages and home loans in the UK to non-residents, the paperwork you'll need to get your loan, the legal ins and outs and what it might cost. Mortgages in the UK : What types of mortgages are available? The mortgage market in the UK is very well developed. In fact, the choice of different mortgage ANZ home loans with variable and fixed rate options available. Use our calculator and comparison tools to explore our home loan and repayments options.

Interest rates are subject to change. The calculators do not take into account applicable fees, taxes (including withholding tax), levies and charges. To the extent permitted by law, ANZ makes no warranty and accepts no liability in respect of your use of and reliance on these calculators. ANZ lending criteria, terms, conditions, and fees apply It is shown as a percentage of the property's value, so if you bought a house for ВЈ200,000, a 10% deposit would come to ВЈ20,000. Your mortgage provider will lend you the rest, which is called the loan to value (LTV). In the above example a 90% LTV mortgage would cover the remaining ВЈ180,000, which would be the amount you owe your lender.

Use our mortgage repayment calculator as a guide to what your mortgage repayments could be on your new home loan. Start a conversation with a Westpac expert today. The ANZ also has a good report tailored to the property market. When deciding about structuring your home loan it is always best to gather information from a number of sources - then you can be assured that you are getting the full picture - or as close to it as you can given that nobody can predict the future.

Mortgage calculators Before you take out a mortgage with us, use our calculators to get a good idea of how much you could borrow and how much your monthly repayments might be. If you already have a Nationwide mortgage, our calculators could help you understand how changes to your mortgage could affect your repayments. ANZ helps you figure out how much you need to save for a house deposit by unpacking loan to value ratio, deposit size and lenders mortgage insurance.

ANZ can help you get a better view of a home's potential price with a free Property Profile Report. Request your free ANZ Property Profile Report online now. This guide will teach you everything you need to know about ANZ’s pre approval. Pre approval basics. Cool features specific to ANZ. And three new case studies that I’ve never shared anywhere else before.

You can put mortgage payment on hold by taking a temporary mortgage holiday, where your payments are paused. Here's how it works. ANZ Mortgages Servicing. To 'make changes' to your existing ANZ Home Loan or Investment Loan: ANZ Internet Banking: Log on to ANZ Internet Banking to manage your loan online. View demonstration to find out more about managing your ANZ Home or Investment Loan online. Phone: Call 13 25 99, 8.00am to 9.30pm AEST, Monday to Friday Fax: 1300 655 706 Mail: ANZ Mortgages Servicing Locked Bag 9

24/08/2014 · The ANZ Breakfree Home Loan Package Fixed gives you the choice of locking your rate over a variety of periods, from as little as 1 year to as many as … Mortgage interest rates Reverse mortgages Term deposit interest rates Credit cards Calculators Alternative assets KiwiSaver Gold & silver prices - Gold coin prices - Gold bar prices - Precious metal scrap prices Protection from scams

It is shown as a percentage of the property's value, so if you bought a house for ВЈ200,000, a 10% deposit would come to ВЈ20,000. Your mortgage provider will lend you the rest, which is called the loan to value (LTV). In the above example a 90% LTV mortgage would cover the remaining ВЈ180,000, which would be the amount you owe your lender. ANZ helps you figure out how much you need to save for a house deposit by unpacking loan to value ratio, deposit size and lenders mortgage insurance.

ANZ Buy Ready offers useful tools, free reports and in-depth resources to help you calculate, buy, save and sell. Mortgage calculators Before you take out a mortgage with us, use our calculators to get a good idea of how much you could borrow and how much your monthly repayments might be. If you already have a Nationwide mortgage, our calculators could help you understand how changes to your mortgage could affect your repayments.

21/09/2012В В· A property mortgage is the biggest debt most of us will ever take on. So choosing the right one is vital. Tim Bennett explains the basics of mortgages and highlights the main pitfalls to avoid. Reverse mortgage: Is it good or bad? A reverse mortgage is a type of loan that cater to homeowners aged 62 and upwards. This loan converts their home equity into much needed cash. This program can help retirees and become an effective tool for them to assist in their financial needs. However there are things to consider and if done hastily and...

At Mortgage House we have a range of mortgage calculators that can give you an idea of what your weekly, fortnightly or monthly repayments may be, how much you might be able to borrow, how much interest you will pay and even what your stamp duty costs will be. The great thing is that you can gather all this information even before you apply for 24/08/2014 · The ANZ Breakfree Home Loan Package Fixed gives you the choice of locking your rate over a variety of periods, from as little as 1 year to as many as …

Accurate Mortgage Calculators Mortgage House Tools. ANZ home loan calculators and tools can help you work out the numbers and explore home loans that may suit your needs. Compare our home loan options today., Whether you're a first home buyer, or looking to buy your next, ANZ can help. Get guides, tools and tips on the home buying process here..

Finance for Building and Renovating ANZ

UK mortgages and home loans A foreigner's guide. Although there were days it felt like it would never happen, the much-awaited day is here: you've made the final payment on your mortgage. You're about to own your home free and clear of any debt, Reverse mortgage: Is it good or bad? A reverse mortgage is a type of loan that cater to homeowners aged 62 and upwards. This loan converts their home equity into much needed cash. This program can help retirees and become an effective tool for them to assist in their financial needs. However there are things to consider and if done hastily and....

Mortgage repayment calculator Calculate interest ASB

Beginners' guide to mortgages MoneyWeek investment tutorials. Can’t make a lump sum payment in ANZ Internet Banking or ANZ goMoney – loan types The ability to make a lump sum payment in ANZ Internet Banking and ANZ goMoney is currently only available if your ANZ Home Loan has a floating interest rate or if you have an ANZ … ANZ Buy Ready offers useful tools, free reports and in-depth resources to help you calculate, buy, save and sell..

26/05/2013В В· Fix a rate up to 10 years with the ANZ Fixed Rate Home Loan. 100% offset accounts are available on one year fixed rates, and you can make extra repayments. Mortgagee sales are offered under different terms and conditions. As the mortgagee is not the owner of the property, it offers the property for sale under different terms and conditions. For example, most mortgagee sales are not offered for sale with vacant possession and do not include chattels in the sale.

Mortgage calculators Before you take out a mortgage with us, use our calculators to get a good idea of how much you could borrow and how much your monthly repayments might be. If you already have a Nationwide mortgage, our calculators could help you understand how changes to your mortgage could affect your repayments. 26/05/2013В В· Fix a rate up to 10 years with the ANZ Fixed Rate Home Loan. 100% offset accounts are available on one year fixed rates, and you can make extra repayments.

Whether you're a first home buyer, or looking to buy your next, ANZ can help. Get guides, tools and tips on the home buying process here. ANZ can help you get a better view of a home's potential price with a free Property Profile Report. Request your free ANZ Property Profile Report online now.

Reverse mortgage: Is it good or bad? A reverse mortgage is a type of loan that cater to homeowners aged 62 and upwards. This loan converts their home equity into much needed cash. This program can help retirees and become an effective tool for them to assist in their financial needs. However there are things to consider and if done hastily and... At Mortgage House we have a range of mortgage calculators that can give you an idea of what your weekly, fortnightly or monthly repayments may be, how much you might be able to borrow, how much interest you will pay and even what your stamp duty costs will be. The great thing is that you can gather all this information even before you apply for

The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Compare today. The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Compare today.

Building and renovating. Building a new home from scratch or renovating your existing one can be a great way to get the home you’ve always wanted. ANZ can help you finance a build or major renovation and an ANZ Construction Coach can guide you every step of the way. ANZ Mortgages Collections assists home loan customers who are experiencing financial difficulty. Depending on your circumstances, our staff may be able to assist by: Extending the loan term. Deferring repayments. Accepting interest only payments for an agreed period of time. Consolidating other debts into the mortgage.

Paying off your mortgage ahead of schedule could be a good idea if you want to save money on interest. In the process of getting rid of your home loan just one or two years early, you could potentially save hundreds (or even thousands) of dollars. But if you’re planning to take that approach, it This guide will teach you everything you need to know about ANZ’s pre approval. Pre approval basics. Cool features specific to ANZ. And three new case studies that I’ve never shared anywhere else before.

ANZ can help you get a better view of a home's potential price with a free Property Profile Report. Request your free ANZ Property Profile Report online now. Nationwide, ANZ Research expects prices to rise strongly through to the end of 2019, driven by Sydney and Melbourne, after which gains are expected to moderate to around 6 per cent in 2020 and 4 per cent in 2021. “The recovery in prices has been driven by Sydney and Melbourne… Prices are up 3 per cent in both cities in the past three months.”

Nationwide, ANZ Research expects prices to rise strongly through to the end of 2019, driven by Sydney and Melbourne, after which gains are expected to moderate to around 6 per cent in 2020 and 4 per cent in 2021. “The recovery in prices has been driven by Sydney and Melbourne… Prices are up 3 per cent in both cities in the past three months.” Mortgage calculators Before you take out a mortgage with us, use our calculators to get a good idea of how much you could borrow and how much your monthly repayments might be. If you already have a Nationwide mortgage, our calculators could help you understand how changes to your mortgage could affect your repayments.

Interest rates are subject to change. The calculators do not take into account applicable fees, taxes (including withholding tax), levies and charges. To the extent permitted by law, ANZ makes no warranty and accepts no liability in respect of your use of and reliance on these calculators. ANZ lending criteria, terms, conditions, and fees apply Mortgagee sales are offered under different terms and conditions. As the mortgagee is not the owner of the property, it offers the property for sale under different terms and conditions. For example, most mortgagee sales are not offered for sale with vacant possession and do not include chattels in the sale.

This handy guide covers which banks offer mortgages and home loans in the UK to non-residents, the paperwork you'll need to get your loan, the legal ins and outs and what it might cost. Mortgages in the UK : What types of mortgages are available? The mortgage market in the UK is very well developed. In fact, the choice of different mortgage It is shown as a percentage of the property's value, so if you bought a house for ВЈ200,000, a 10% deposit would come to ВЈ20,000. Your mortgage provider will lend you the rest, which is called the loan to value (LTV). In the above example a 90% LTV mortgage would cover the remaining ВЈ180,000, which would be the amount you owe your lender.

Mobile mortgage manager Fiji ANZ

How much do you really need for a house deposit? ANZ. Reverse mortgage: Is it good or bad? A reverse mortgage is a type of loan that cater to homeowners aged 62 and upwards. This loan converts their home equity into much needed cash. This program can help retirees and become an effective tool for them to assist in their financial needs. However there are things to consider and if done hastily and..., At Mortgage House we have a range of mortgage calculators that can give you an idea of what your weekly, fortnightly or monthly repayments may be, how much you might be able to borrow, how much interest you will pay and even what your stamp duty costs will be. The great thing is that you can gather all this information even before you apply for.

Aus housing on the rebound bluenotes.anz.com

Mobile mortgage manager Fiji ANZ. Is is cheaper to buy or build a house? Which option will give you what you want, at a price you can afford? This complete guide to building a house will help you answer that question and get the, ANZ home loans with variable and fixed rate options available. Use our calculator and comparison tools to explore our home loan and repayments options..

ANZ Mortgages Servicing. To 'make changes' to your existing ANZ Home Loan or Investment Loan: ANZ Internet Banking: Log on to ANZ Internet Banking to manage your loan online. View demonstration to find out more about managing your ANZ Home or Investment Loan online. Phone: Call 13 25 99, 8.00am to 9.30pm AEST, Monday to Friday Fax: 1300 655 706 Mail: ANZ Mortgages Servicing Locked Bag 9 Tip. To remove a spouse from a mortgage loan, you must refinance the property yourself. If your credit is good enough and your income is high enough, the lender will likely agree to let your

ANZ provides first time buyers with a home loan guide on house deposits, buying off the plan, borrowing power and other useful home loan tips. Learn more. Whether you're a first home buyer, or looking to buy your next, ANZ can help. Get guides, tools and tips on the home buying process here.

ANZ helps you figure out how much you need to save for a house deposit by unpacking loan to value ratio, deposit size and lenders mortgage insurance. Nationwide, ANZ Research expects prices to rise strongly through to the end of 2019, driven by Sydney and Melbourne, after which gains are expected to moderate to around 6 per cent in 2020 and 4 per cent in 2021. “The recovery in prices has been driven by Sydney and Melbourne… Prices are up 3 per cent in both cities in the past three months.”

This handy guide covers which banks offer mortgages and home loans in the UK to non-residents, the paperwork you'll need to get your loan, the legal ins and outs and what it might cost. Mortgages in the UK : What types of mortgages are available? The mortgage market in the UK is very well developed. In fact, the choice of different mortgage ANZ home loan calculators and tools can help you work out the numbers and explore home loans that may suit your needs. Compare our home loan options today.

21/09/2012В В· A property mortgage is the biggest debt most of us will ever take on. So choosing the right one is vital. Tim Bennett explains the basics of mortgages and highlights the main pitfalls to avoid. 21/09/2012В В· A property mortgage is the biggest debt most of us will ever take on. So choosing the right one is vital. Tim Bennett explains the basics of mortgages and highlights the main pitfalls to avoid.

Building and renovating. Building a new home from scratch or renovating your existing one can be a great way to get the home you’ve always wanted. ANZ can help you finance a build or major renovation and an ANZ Construction Coach can guide you every step of the way. ANZ provides first time buyers with a home loan guide on house deposits, buying off the plan, borrowing power and other useful home loan tips. Learn more.

A service brought to you by ANZ. LifeGuides Selling your home When’s the right time to sell? Try not to sell in a hurry. A seller in a hurry can’t wait to realise the true value of their home. Try not to sell on a whim or without doing your homework. Be wary of selling because you’ve already purchased elsewhere. It’s common for people to rush into a purchase because they fall in love Building and renovating. Building a new home from scratch or renovating your existing one can be a great way to get the home you’ve always wanted. ANZ can help you finance a build or major renovation and an ANZ Construction Coach can guide you every step of the way.

ANZ home loan calculators and tools can help you work out the numbers and explore home loans that may suit your needs. Compare our home loan options today. ANZ provides first time buyers with a home loan guide on house deposits, buying off the plan, borrowing power and other useful home loan tips. Learn more.

Use our mortgage repayment calculator as a guide to what your mortgage repayments could be on your new home loan. Start a conversation with a Westpac expert today. At Mortgage House we have a range of mortgage calculators that can give you an idea of what your weekly, fortnightly or monthly repayments may be, how much you might be able to borrow, how much interest you will pay and even what your stamp duty costs will be. The great thing is that you can gather all this information even before you apply for

This calculator provides an estimate/illustration only and is based on the accuracy of the limited financial information provided by you. Results are based on amortised scheduled repayments with a constant interest rate for the term of the loan. This is not an offer of finance by ANZ and a full lending application is required to be completed. Interest rates are subject to change. The calculators do not take into account applicable fees, taxes (including withholding tax), levies and charges. To the extent permitted by law, ANZ makes no warranty and accepts no liability in respect of your use of and reliance on these calculators. ANZ lending criteria, terms, conditions, and fees apply

Can I put mortgage payments on hold? Finder

UK mortgages and home loans A foreigner's guide. ANZ Mortgages Collections assists home loan customers who are experiencing financial difficulty. Depending on your circumstances, our staff may be able to assist by: Extending the loan term. Deferring repayments. Accepting interest only payments for an agreed period of time. Consolidating other debts into the mortgage., This handy guide covers which banks offer mortgages and home loans in the UK to non-residents, the paperwork you'll need to get your loan, the legal ins and outs and what it might cost. Mortgages in the UK : What types of mortgages are available? The mortgage market in the UK is very well developed. In fact, the choice of different mortgage.

Aus housing on the rebound bluenotes.anz.com. ANZ home loans with variable and fixed rate options available. Use our calculator and comparison tools to explore our home loan and repayments options., A service brought to you by ANZ. LifeGuides Selling your home When’s the right time to sell? Try not to sell in a hurry. A seller in a hurry can’t wait to realise the true value of their home. Try not to sell on a whim or without doing your homework. Be wary of selling because you’ve already purchased elsewhere. It’s common for people to rush into a purchase because they fall in love.

ANZ Expat Mortgages

Mortgage repayment calculator Calculate interest ASB. Tip. To remove a spouse from a mortgage loan, you must refinance the property yourself. If your credit is good enough and your income is high enough, the lender will likely agree to let your ANZ Mortgages Collections assists home loan customers who are experiencing financial difficulty. Depending on your circumstances, our staff may be able to assist by: Extending the loan term. Deferring repayments. Accepting interest only payments for an agreed period of time. Consolidating other debts into the mortgage..

The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Compare today. You can put mortgage payment on hold by taking a temporary mortgage holiday, where your payments are paused. Here's how it works.

You can put mortgage payment on hold by taking a temporary mortgage holiday, where your payments are paused. Here's how it works. Nationwide, ANZ Research expects prices to rise strongly through to the end of 2019, driven by Sydney and Melbourne, after which gains are expected to moderate to around 6 per cent in 2020 and 4 per cent in 2021. “The recovery in prices has been driven by Sydney and Melbourne… Prices are up 3 per cent in both cities in the past three months.”

ANZ Mortgages Servicing. To 'make changes' to your existing ANZ Home Loan or Investment Loan: ANZ Internet Banking: Log on to ANZ Internet Banking to manage your loan online. View demonstration to find out more about managing your ANZ Home or Investment Loan online. Phone: Call 13 25 99, 8.00am to 9.30pm AEST, Monday to Friday Fax: 1300 655 706 Mail: ANZ Mortgages Servicing Locked Bag 9 The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Compare today.

Although there were days it felt like it would never happen, the much-awaited day is here: you've made the final payment on your mortgage. You're about to own your home free and clear of any debt You can put mortgage payment on hold by taking a temporary mortgage holiday, where your payments are paused. Here's how it works.

This calculator provides an estimate/illustration only and is based on the accuracy of the limited financial information provided by you. Results are based on amortised scheduled repayments with a constant interest rate for the term of the loan. This is not an offer of finance by ANZ and a full lending application is required to be completed. This handy guide covers which banks offer mortgages and home loans in the UK to non-residents, the paperwork you'll need to get your loan, the legal ins and outs and what it might cost. Mortgages in the UK : What types of mortgages are available? The mortgage market in the UK is very well developed. In fact, the choice of different mortgage

Interest rates are subject to change. The calculators do not take into account applicable fees, taxes (including withholding tax), levies and charges. To the extent permitted by law, ANZ makes no warranty and accepts no liability in respect of your use of and reliance on these calculators. ANZ lending criteria, terms, conditions, and fees apply Is is cheaper to buy or build a house? Which option will give you what you want, at a price you can afford? This complete guide to building a house will help you answer that question and get the

Use our online home loan calculator tool to calculate how much your interest & mortgage repayments could be. Use the online calculator or call us today. Nationwide, ANZ Research expects prices to rise strongly through to the end of 2019, driven by Sydney and Melbourne, after which gains are expected to moderate to around 6 per cent in 2020 and 4 per cent in 2021. “The recovery in prices has been driven by Sydney and Melbourne… Prices are up 3 per cent in both cities in the past three months.”

If you’re moving to France and are tempted to buy a home there, you might be wondering how difficult or expensive it is for to get a French mortgage. This guide explains everything you need to know before buying your dream French property. Paying off your mortgage ahead of schedule could be a good idea if you want to save money on interest. In the process of getting rid of your home loan just one or two years early, you could potentially save hundreds (or even thousands) of dollars. But if you’re planning to take that approach, it

ANZ provides first time buyers with a home loan guide on house deposits, buying off the plan, borrowing power and other useful home loan tips. Learn more. Is is cheaper to buy or build a house? Which option will give you what you want, at a price you can afford? This complete guide to building a house will help you answer that question and get the

This calculator provides an estimate/illustration only and is based on the accuracy of the limited financial information provided by you. Results are based on amortised scheduled repayments with a constant interest rate for the term of the loan. This is not an offer of finance by ANZ and a full lending application is required to be completed. Use our online home loan calculator tool to calculate how much your interest & mortgage repayments could be. Use the online calculator or call us today.

If you’re moving to France and are tempted to buy a home there, you might be wondering how difficult or expensive it is for to get a French mortgage. This guide explains everything you need to know before buying your dream French property. The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Compare today.