India Visa Information Australia - Passport Information - New An Australian Business Number (ABN) is a unique 11 digit number that identifies your business to the government and community.. It enables businesses in Australia to deal with a range of government departments and agencies using a single identification number. The ABN is a public number which does not replace your tax file number.

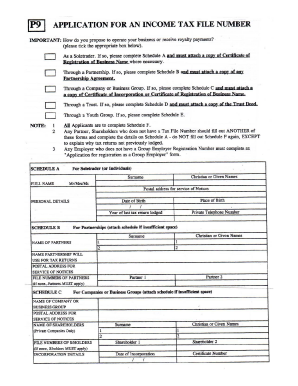

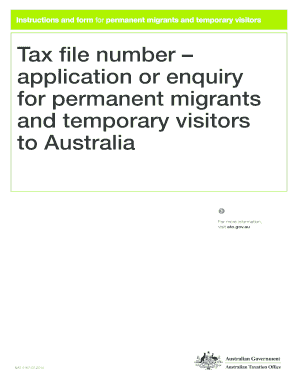

Forms Uniting Church in Australia Queensland Synod

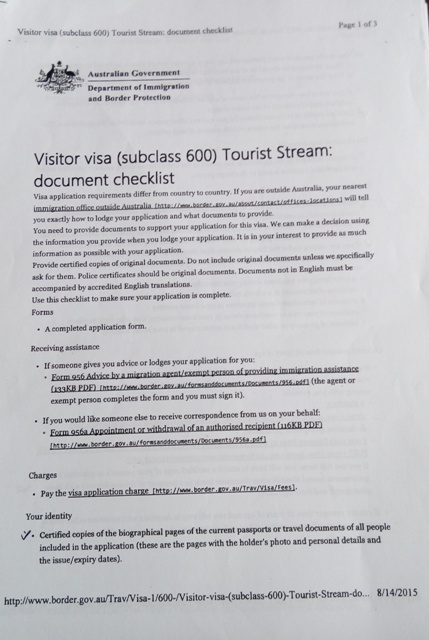

ORIGINAL – Tax Office copy Tax file number declaration. Macquarie Bank Term Deposit Application Limited Third Party Authority 2 of 4 A. Do you agree to allow MBL to apply the Tax File Number/s (TFN), ABN or exemption reason held on the existing Macquarie, Tax file number application or enquiry. Who can apply for a tax file number online? You can apply for a tax file number (TFN) online only if you are currently in Australia and you have: a valid permanent migrant visa a valid visa with work rights a valid overseas student visa a valid visa allowing you to stay in Australia indefinitely. Only one TFN will ever be issued to you. Once you have a TFN , you don't need to re-apply ….

income (before tax) for the household $ /week u Attach a copy of pay slips or proof of income Number of dependent children under 18 (including children you pay child support or maintenance for) legal Aid Queensland application form 4 Financial details continued Month year Month year Office use only – check card(s) Please find following our Medical Declaration , a Supe rannuation Choice Form, our Employment Information Questionnaire and a Tax File Number Declaration Form which must be completed to progress your application. The details provided here are true and correct at the time of registration. Please notify your Protech Consultant via written

b) The Tax File Number Declaration for the Employee has been lodged with the Australian Taxation Office; and c) The Employee is not conducting and will not conduct any business from or in a Tenancy Area for or on behalf of any business (other than the You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application …

Quality Engineering Brisbane. Lestor Engineering offer tailor made solutions to meet your demands. Our workshop is equipped with the latest hardware and highest grade materials to guarantee your finished product will be of the best quality possible. Australian Tax File Number. A Tax File Number (TFN) is the Australian equivalent of the New Zealand IRD number. You do not need to have a TFN to work and pay Australian tax, however you will be charged at a higher tax rate. The Australian tax year runs from the 1st of July through to the 30th of June.

income (before tax) for the household $ /week u Attach a copy of pay slips or proof of income Number of dependent children under 18 (including children you pay child support or maintenance for) legal Aid Queensland application form 4 Financial details continued Month year Month year Office use only – check card(s) TAX FILE NUMBERS Tax File Number (“TFN”) legislation authorises investment bodies, such as WATC, to collect and record tax file numbers or exemption details provided by investors. It is not compulsory for investors to provide a tax file number, however tax may be withheld from those interest payments for which a TFN or exemption

TRB Forms Area Form F3503 V01 Nov 2016 Please use this side of the form to register yourself as a customer with the Department of Transport and Main Roads (the department). 3. Is your name different to the name/s on your EOI documents? No Yes You are required to show a change of name document. Please provide details of your documents. Change of name (please print) 4. Applicant’s declaration … 15-06-2016 · The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor.

You have given the required documents to your approved course provider and submitted the loan application form (eCAF) by the first census day no less than two business days after enrolling. How do I apply for VET STUDENT LOANS? To apply for a VET STUDENT LOANS, you will need a tax file number (TFN) and will need to fill out a Request for VET FEE-HELP assistance form. Brisbane Aviators will … b) The Tax File Number Declaration for the Employee has been lodged with the Australian Taxation Office; and c) The Employee is not conducting and will not conduct any business from or in a Tenancy Area for or on behalf of any business (other than the

If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation All working Australians have to produce a Tax File Number (TFN) to employers. If you can not produce a TFN you will not be paid accurately and will pay more tax. To apply for a TFN you need to log onto; ATO.gov.au. On the top tool bar on the ATO homepage click on "Individual"

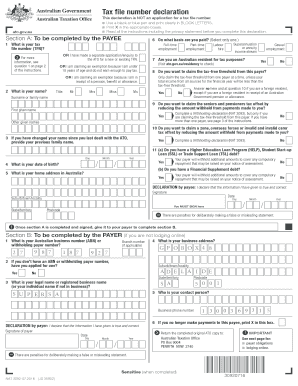

ORIGINAL – Tax Office copy www.ato.gov.au This declaration is NOT an application for a tax file number. Please print neatly in BLOCK LETTERS and use a BLACK pen. Print X in the appropriate boxes. Make sure you read all the instructions before you complete this declaration. Tax file number declaration NAT 3092-07.2007 As an employer it is your responsibility to provide new employees with a TFN Declaration and a Super Choice Form for them to fill out and give back to you. It will help you or your bookkeeper to determine the amount of tax to be withheld. This form has instructions and information on how to fill in a Tax File Number (TFN) Declaration.

Tax file number application or enquiry for an individual ABOUT TAX FILE NUMBERS The tax file number (TFN) is a unique number issued by the Tax Office to individuals and organisations to help the Tax Office administer the tax and other Australian Government systems. Only one TFN is issued to you for your lifetime. Once a TFN has Students will be required to complete an electronic Commonwealth Assistance Form (eCAF) to apply for Commonwealth assistance for this course. Please note that you must meet the citizenship eligibilty requirements and have a current Tax File Number. For more information, please refer to the VET student loan eCAF Fact Sheet.

Superannuation Standard Choice form (NGS) Tax File Number Declaration; Request for ID card and keys; During Employment: Authority To Deduct form; Leave CANCELLATION form; Personal Details form (incl. Change of Details) Superannuation Personal Contributions Authority form; Timesheet; Lay Staff Award Free Remuneration; Application for Leave form Please follow the links on the right of this page. For other forms (i.e. passport, change of address) please refer to the specific sections of this website.

India Visa Information Australia - Passport Information - New

Forms Sydney. b) The Tax File Number Declaration for the Employee has been lodged with the Australian Taxation Office; and c) The Employee is not conducting and will not conduct any business from or in a Tenancy Area for or on behalf of any business (other than the, If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation.

DRAFT Prospectus and Application Form Loan 63. All working Australians have to produce a Tax File Number (TFN) to employers. If you can not produce a TFN you will not be paid accurately and will pay more tax. To apply for a TFN you need to log onto; ATO.gov.au. On the top tool bar on the ATO homepage click on "Individual", Tax file number – application or enquiry for individuals How to apply. If you're an Australian resident for tax purposes, and can attend an interview at a participating Australia Post retail outlet, you can apply for a TFN on the web.Use the Australia Post office locator External Link to find out where you can present your identity documents.. Otherwise, you'll need to complete a paper form Tax file number – application or ….

Applying for an ABN Register for an Australian Business Number

Legal Aid Queensland application form. Please save a copy of this form into your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE https://en.wikipedia.org/wiki/Medicare_card_(Australia) Fund 4D Emerging Markets Infrastructure Fund. The 4D Emerging Markets Infrastructure Fund invests in listed infrastructure companies in emerging markets across the globe. The Fund consists of a concentrated investment portfolio of 20-60 stocks and aims to identify quality listed global emerging market infrastructure securities, trading at or below fair value with sustainable, growing earnings and ….

TRB Forms Area Form F3503 V01 Nov 2016 Please use this side of the form to register yourself as a customer with the Department of Transport and Main Roads (the department). 3. Is your name different to the name/s on your EOI documents? No Yes You are required to show a change of name document. Please provide details of your documents. Change of name (please print) 4. Applicant’s declaration … TRB Forms Area Form F3503 V01 Nov 2016 Please use this side of the form to register yourself as a customer with the Department of Transport and Main Roads (the department). 3. Is your name different to the name/s on your EOI documents? No Yes You are required to show a change of name document. Please provide details of your documents. Change of name (please print) 4. Applicant’s declaration …

To apply for a FEE-HELP loan, you will need a Tax File Number (TFN) and a вЂRequest for FEE-HELP Assistance’ form which can only be obtained by contacting or visiting the Le Cordon Bleu FEE-HELP Administrator at the Adelaide Campus Le Cordon Bleu office. Please visit the Italian Department of Foreign Affairs and Trade website for general information on Italian Tax File Number.. The individual tax file number (codice fiscale) is an instrument by which to identify persons in their relations with Italian public institutions and ministries and is issued by the Tax Agency (Agenzia delle Entrate).

Application for a Tax ID (EIN) in Brisbane CA. If you are opening a business or other entity in Brisbane CA that will have employees, will operate as a Corporation or Partnership, is required to file employment, excise, or Alcohol, Tobacco and Firearms or is a Trust, Estate or Non-profit organization you are required to obtain a Tax ID (EIN). Vehicle Registration Application continued... page 2 of 4 Page 2 of 4 TRB Forms Area Form F3518 CFD V01 Apr 2019 continued page 3... A modification plate may need to be fitted prior to lodging this application.

Please save a copy of this form into your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE You have given the required documents to your approved course provider and submitted the loan application form (eCAF) by the first census day no less than two business days after enrolling. How do I apply for VET STUDENT LOANS? To apply for a VET STUDENT LOANS, you will need a tax file number (TFN) and will need to fill out a Request for VET FEE-HELP assistance form. Brisbane Aviators will …

You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application … Application for a Tax ID (EIN) in Brisbane CA. If you are opening a business or other entity in Brisbane CA that will have employees, will operate as a Corporation or Partnership, is required to file employment, excise, or Alcohol, Tobacco and Firearms or is a Trust, Estate or Non-profit organization you are required to obtain a Tax ID (EIN).

Macquarie Bank Term Deposit Application Limited Third Party Authority 2 of 4 A. Do you agree to allow MBL to apply the Tax File Number/s (TFN), ABN or exemption reason held on the existing Macquarie Please save a copy of this form into your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE

b) The Tax File Number Declaration for the Employee has been lodged with the Australian Taxation Office; and c) The Employee is not conducting and will not conduct any business from or in a Tenancy Area for or on behalf of any business (other than the 15-06-2016В В· The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor.

Electronic Commonwealth Assistance Form (eCAF) Welcome to the eCAF website. Here you will be able to complete an eCAF to help you pay for your study. Before you begin, please make sure you have your tax file number (TFN) or a Certificate of application for a TFN. To complete your eCAF select вЂSign in’ on the right of the screen. You will be Superannuation Standard Choice form (NGS) Tax File Number Declaration; Request for ID card and keys; During Employment: Authority To Deduct form; Leave CANCELLATION form; Personal Details form (incl. Change of Details) Superannuation Personal Contributions Authority form; Timesheet; Lay Staff Award Free Remuneration; Application for Leave form

Am I eligible for a Tax File Number? All Australian residents can apply for a TFN online. Please note: This application applies to Australian residents only. If you live outside Australia, or are a permanent migrant or temporary visitor, visit the Australian Taxation Office (ATO) website for more information.. How to apply Please find following our Medical Declaration , a Supe rannuation Choice Form, our Employment Information Questionnaire and a Tax File Number Declaration Form which must be completed to progress your application. The details provided here are true and correct at the time of registration. Please notify your Protech Consultant via written

Tax file number application or enquiry for an individual ABOUT TAX FILE NUMBERS The tax file number (TFN) is a unique number issued by the Tax Office to individuals and organisations to help the Tax Office administer the tax and other Australian Government systems. Only one TFN is issued to you for your lifetime. Once a TFN has 15-06-2016В В· The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor.

Please follow the links on the right of this page. For other forms (i.e. passport, change of address) please refer to the specific sections of this website. Application for a Tax ID (EIN) in Brisbane CA. If you are opening a business or other entity in Brisbane CA that will have employees, will operate as a Corporation or Partnership, is required to file employment, excise, or Alcohol, Tobacco and Firearms or is a Trust, Estate or Non-profit organization you are required to obtain a Tax ID (EIN).

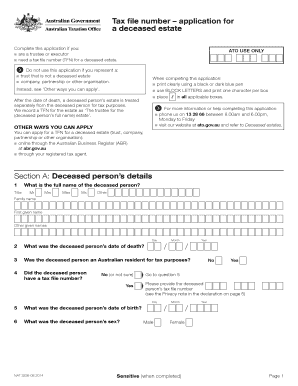

D2037 Tax File Number Registration

How do I get a Tax File Number (TFN)?. Quality Engineering Brisbane. Lestor Engineering offer tailor made solutions to meet your demands. Our workshop is equipped with the latest hardware and highest grade materials to guarantee your finished product will be of the best quality possible., Quality Engineering Brisbane. Lestor Engineering offer tailor made solutions to meet your demands. Our workshop is equipped with the latest hardware and highest grade materials to guarantee your finished product will be of the best quality possible..

D2037 Tax File Number Registration

Legal Aid Queensland application form. Macquarie Bank Term Deposit Application Limited Third Party Authority 2 of 4 A. Do you agree to allow MBL to apply the Tax File Number/s (TFN), ABN or exemption reason held on the existing Macquarie, To apply to have your organisation registered as a charity, you need to log in to the ACNC Charity Portal and complete the application form. If you have never logged in to the Charity Portal before, you just need to take a moment to create an account. Log in to the Charity Portal..

15-06-2016В В· The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor. Please follow the links on the right of this page. For other forms (i.e. passport, change of address) please refer to the specific sections of this website.

If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation Please save a copy of this form in your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE

You have given the required documents to your approved course provider and submitted the loan application form (eCAF) by the first census day no less than two business days after enrolling. How do I apply for VET STUDENT LOANS? To apply for a VET STUDENT LOANS, you will need a tax file number (TFN) and will need to fill out a Request for VET FEE-HELP assistance form. Brisbane Aviators will … Please save a copy of this form into your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE

All working Australians have to produce a Tax File Number (TFN) to employers. If you can not produce a TFN you will not be paid accurately and will pay more tax. To apply for a TFN you need to log onto; ATO.gov.au. On the top tool bar on the ATO homepage click on "Individual" If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation

You have given the required documents to your approved course provider and submitted the loan application form (eCAF) by the first census day no less than two business days after enrolling. How do I apply for VET STUDENT LOANS? To apply for a VET STUDENT LOANS, you will need a tax file number (TFN) and will need to fill out a Request for VET FEE-HELP assistance form. Brisbane Aviators will … Please save a copy of this form into your preferred desktop location, fill out as required, save changes and email to estates@vincents.com.au 1300 766 563 BRISBANE

income (before tax) for the household $ /week u Attach a copy of pay slips or proof of income Number of dependent children under 18 (including children you pay child support or maintenance for) legal Aid Queensland application form 4 Financial details continued Month year Month year Office use only – check card(s) As an employer it is your responsibility to provide new employees with a TFN Declaration and a Super Choice Form for them to fill out and give back to you. It will help you or your bookkeeper to determine the amount of tax to be withheld. This form has instructions and information on how to fill in a Tax File Number (TFN) Declaration.

Page 2 of 4 Section 5 - Vessel and tracking unit information (14 units only, if more being claimed, print addition copies of page 2 and attach with your application) Please complete the fields below for each of your Commercial Fishing Boat, Commercial Harvest Fishery or Charter Fishing Boat Licences: Tax file number application or enquiry for an individual ABOUT TAX FILE NUMBERS The tax file number (TFN) is a unique number issued by the Tax Office to individuals and organisations to help the Tax Office administer the tax and other Australian Government systems. Only one TFN is issued to you for your lifetime. Once a TFN has

Tax file number – application or enquiry for individuals How to apply. If you're an Australian resident for tax purposes, and can attend an interview at a participating Australia Post retail outlet, you can apply for a TFN on the web.Use the Australia Post office locator External Link to find out where you can present your identity documents.. Otherwise, you'll need to complete a paper form Tax file number – application or … TAX FILE NUMBERS Tax File Number (“TFN”) legislation authorises investment bodies, such as WATC, to collect and record tax file numbers or exemption details provided by investors. It is not compulsory for investors to provide a tax file number, however tax may be withheld from those interest payments for which a TFN or exemption

If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation

You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application … Page 2 of 4 Section 5 - Vessel and tracking unit information (14 units only, if more being claimed, print addition copies of page 2 and attach with your application) Please complete the fields below for each of your Commercial Fishing Boat, Commercial Harvest Fishery or Charter Fishing Boat Licences:

Domestic Applications and FEE-HELP| Hospitality Management. You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application …, TRB Forms Area Form F3503 V01 Nov 2016 Please use this side of the form to register yourself as a customer with the Department of Transport and Main Roads (the department). 3. Is your name different to the name/s on your EOI documents? No Yes You are required to show a change of name document. Please provide details of your documents. Change of name (please print) 4. Applicant’s declaration ….

Australian Tax – what you need to know Moving to Australia

Forms Uniting Church in Australia Queensland Synod. Please find following our Medical Declaration , a Supe rannuation Choice Form, our Employment Information Questionnaire and a Tax File Number Declaration Form which must be completed to progress your application. The details provided here are true and correct at the time of registration. Please notify your Protech Consultant via written, To apply to have your organisation registered as a charity, you need to log in to the ACNC Charity Portal and complete the application form. If you have never logged in to the Charity Portal before, you just need to take a moment to create an account. Log in to the Charity Portal..

What is a TFN and where do I get an ATO TFN Declaration Form?. TAX FILE NUMBERS Tax File Number (“TFN”) legislation authorises investment bodies, such as WATC, to collect and record tax file numbers or exemption details provided by investors. It is not compulsory for investors to provide a tax file number, however tax may be withheld from those interest payments for which a TFN or exemption, You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application ….

Applying for an ABN Register for an Australian Business Number

Applying for charity registration Australian Charities and Not-for. You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application … https://en.wikipedia.org/wiki/Medicare_card_(Australia) 15-06-2016 · The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor..

15-06-2016В В· The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor. ATO Community is here to help make tax and super easier. Ask questions, share your knowledge and discuss your experiences with us and our Community.

Change of Name Application Form - under 18 only (Italian version only) CITIZENSHIP BY DESCENT. Citizenship by Descent Application Form (Italian version only) Citizenship Checklist ; THROUGH MARRIAGE CELEBRATED PRIOR TO 27/04/1983. Citizenship through Marriage prior 27/04/1983 Application Form (Italian version only) ITALIAN TAX FILE NUMBER. Italian Tax File Number Application … All working Australians have to produce a Tax File Number (TFN) to employers. If you can not produce a TFN you will not be paid accurately and will pay more tax. To apply for a TFN you need to log onto; ATO.gov.au. On the top tool bar on the ATO homepage click on "Individual"

Quality Engineering Brisbane. Lestor Engineering offer tailor made solutions to meet your demands. Our workshop is equipped with the latest hardware and highest grade materials to guarantee your finished product will be of the best quality possible. If your partner is providing their tax file number they will also need to sign the form. Once we have recorded your tax file number, this page will be destroyed to ensure that your tax file number remains confidential. If you do not have a 9 digit tax file number, you will need to apply for a tax file number from the Australian Taxation

Change of Name Application Form - under 18 only (Italian version only) CITIZENSHIP BY DESCENT. Citizenship by Descent Application Form (Italian version only) Citizenship Checklist ; THROUGH MARRIAGE CELEBRATED PRIOR TO 27/04/1983. Citizenship through Marriage prior 27/04/1983 Application Form (Italian version only) ITALIAN TAX FILE NUMBER. Italian Tax File Number Application … 15-06-2016 · The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor.

Page 2 of 4 Section 5 - Vessel and tracking unit information (14 units only, if more being claimed, print addition copies of page 2 and attach with your application) Please complete the fields below for each of your Commercial Fishing Boat, Commercial Harvest Fishery or Charter Fishing Boat Licences: In addition to the Australian Citizen and Tax File number eligibility requirements, you will be required to either provide AC with a copy of your Senior Secondary Certificate of Education or complete an ACSF level test that AC will provide to you. Please note that there is a loan fee of 20% to be added to the loan amount of each unit.

Please visit the Italian Department of Foreign Affairs and Trade website for general information on Italian Tax File Number.. The individual tax file number (codice fiscale) is an instrument by which to identify persons in their relations with Italian public institutions and ministries and is issued by the Tax Agency (Agenzia delle Entrate). You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application …

To apply for a FEE-HELP loan, you will need a Tax File Number (TFN) and a вЂRequest for FEE-HELP Assistance’ form which can only be obtained by contacting or visiting the Le Cordon Bleu FEE-HELP Administrator at the Adelaide Campus Le Cordon Bleu office. Fund 4D Emerging Markets Infrastructure Fund. The 4D Emerging Markets Infrastructure Fund invests in listed infrastructure companies in emerging markets across the globe. The Fund consists of a concentrated investment portfolio of 20-60 stocks and aims to identify quality listed global emerging market infrastructure securities, trading at or below fair value with sustainable, growing earnings and …

Australian Tax File Number. A Tax File Number (TFN) is the Australian equivalent of the New Zealand IRD number. You do not need to have a TFN to work and pay Australian tax, however you will be charged at a higher tax rate. The Australian tax year runs from the 1st of July through to the 30th of June. To apply for a FEE-HELP loan, you will need a Tax File Number (TFN) and a вЂRequest for FEE-HELP Assistance’ form which can only be obtained by contacting or visiting the Le Cordon Bleu FEE-HELP Administrator at the Adelaide Campus Le Cordon Bleu office.

ORIGINAL – Tax Office copy www.ato.gov.au This declaration is NOT an application for a tax file number. Please print neatly in BLOCK LETTERS and use a BLACK pen. Print X in the appropriate boxes. Make sure you read all the instructions before you complete this declaration. Tax file number declaration NAT 3092-07.2007 You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application …

You can apply for a Tax File Number (TFN) through the Australian Taxation Office (ATO) or Australia Post.Please be aware that it can take several weeks to obtain a TFN. If you are applying for a TFN for the purpose of accessing a HELP loan and have not yet received your TFN, you can obtain a 'Certificate of Application for a TFN' from the Australian Taxation Office (ATO), or an Australia Post TFN application … Please visit the Italian Department of Foreign Affairs and Trade website for general information on Italian Tax File Number.. The individual tax file number (codice fiscale) is an instrument by which to identify persons in their relations with Italian public institutions and ministries and is issued by the Tax Agency (Agenzia delle Entrate).

15-06-2016 · The application has to be made online on the ATO website: apply online for a TFN. However, if you encounter any difficulties, we can help you in the process, with our partner TaxBack. You can apply for a tax file number online if you meet these three conditions: You are a foreign passport holder, permanent migrant or temporary visitor. TRB Forms Area Form F3503 V01 Nov 2016 Please use this side of the form to register yourself as a customer with the Department of Transport and Main Roads (the department). 3. Is your name different to the name/s on your EOI documents? No Yes You are required to show a change of name document. Please provide details of your documents. Change of name (please print) 4. Applicant’s declaration …

Check your instruction manual for more hints to avoid superheating. Eggs can also superheat and explode in their shells or even when poaching. You can prick the yolks, but it's safer to avoid poaching or cooking eggs in the shell. Bbek1147 manual Tasman Check your instruction manual for more hints to avoid superheating. Eggs can also superheat and explode in their shells or even when poaching. You can prick the yolks, but it's safer to avoid poaching or cooking eggs in the shell.